Viet Nam outpaces Malaysia and Thailand in 2024 export growth: Nikkei Asia

VGP - Viet Nam stood out among its Southeast Asian peers last year with robust export growth, outpacing peer manufacturing hubs Malaysia and Thailand as the country benefited from supply chain shifts away from China, according to Nikkei Asia.

Viet Nam’s export revenue to the U.S. hits nearly US$119 billion in 2024, up 23.3 percent compared to the previous year

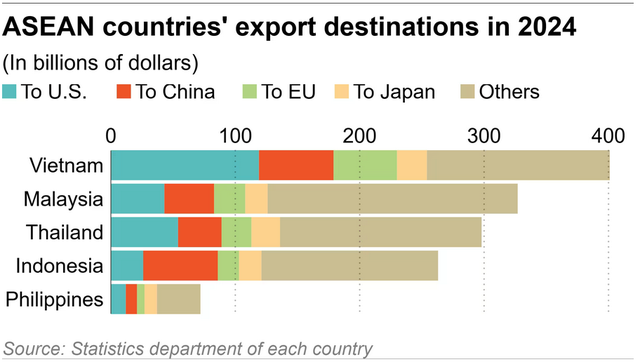

In 2024, Viet Nam's export turnover reached a record high of US$403 billion, an increase of 13.8 percent compared to 2023, higher than Malaysia (5.6 percent), Thailand (5.4 percent) and Indonesia (2.3 percent) and nearly doubling the figure of US$214 billion recorded in 2017.

Two key factors driving this growth include Viet Nam's strong economic relationship with the U.S. and the relocation of suppliers from China.

Viet Nam's exports to the U.S. in 2024 increased by 23.4 percent to US$120 billion, marking the highest growth in the region. Meanwhile, Malaysia's exports to the U.S. grew by 23.2 percent, Indonesia 19.2 percent, and Thailand 13.7 percent.

Viet Nam has been a major beneficiary of suppliers shifting away from China. For example, in 2024, Viet Nam had up to 35 suppliers for Apple, up from 27 in 2023, making it the country with the most Apple suppliers in Southeast Asia. Thailand followed with 24 Apple suppliers, Nikkei Asia noted.

Viet Nam hosts large factories assembling Apple devices such as AirPods, iPads, and Apple Watches. By 2025, Viet Nam is expected to produce 20 percent of all iPads and Apple Watches, 5 percent of MacBooks, and 65 percent of AirPods.

Other major tech companies have also decided to invest in Viet Nam. Facebook's parent company, Meta, will begin manufacturing virtual reality headsets there this year. While the investment amount and factory location have not been disclosed, Meta is expected to create 1,000 jobs by producing Quest 3S in Viet Nam.

Samsung, which operates two large factories in northern Viet Nam and accounted for 15.8 percent of the country's total exports in 2023, plans to invest an additional US$1.8 billion in a new OLED display factory near its existing facilities. Meanwhile, major South Korean firm Hyosung Group has planned to invest US$4 billion in Viet Nam in the coming years.

The Vietnamese Ministry of Industry and Trade has set a target of 10-12 percent in export-import value growth in 2025 compared to 2024, with trade surplus projected to record over US$20 billion.

Total import-export turnover in 2024 is estimated to top US$783.4 billion, up 15 percent against 2023./.