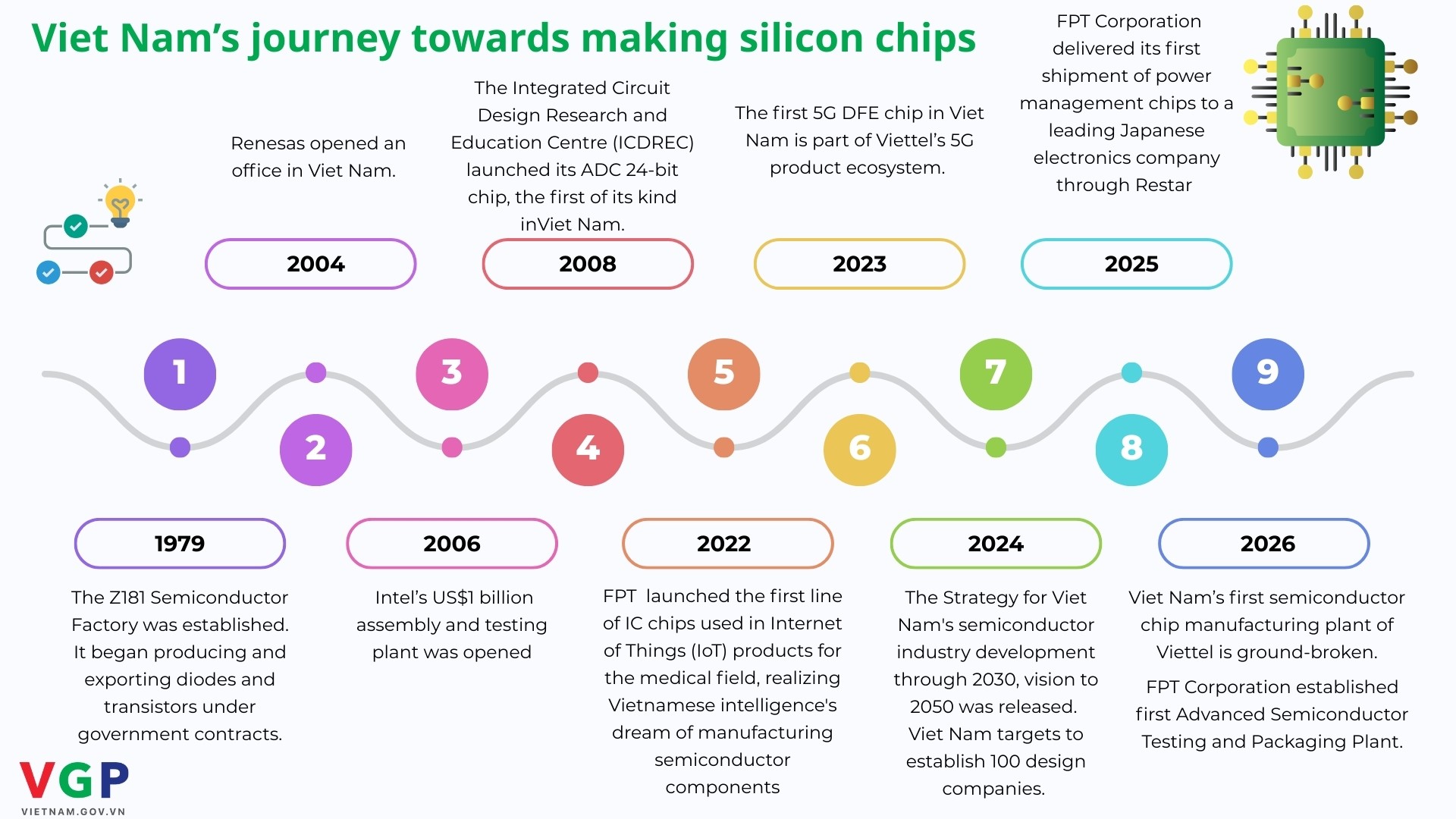

Viet Nam's journey towards making silicon chips

VGP – In the global race for semiconductor supremacy, Viet Nam is moving beyond its traditional role in electronics assembly toward a more ambitious goal: building its own silicon chip industry, spanning design, testing, packaging and domestic fabrication.

The journey is complex, capital-intensive and long-term, but recent developments underscore the country’s determination to master this strategic technology.

A notable milestone came on January 28, when FPT Corporation announced the establishment of its Advanced Semiconductor Testing and Packaging Plant, the first facility of its kind owned by a Vietnamese enterprise. The project contributes to building a national semiconductor ecosystem and marks an important step in strengthening Viet Nam's position in the global semiconductor value chain.

The establishment of the advanced semiconductor chip testing and packaging factory demonstrates FPT's commitment to implementing the Politburo's Resolution No. 57 on breakthroughs in science and technology development, innovation, and national digital transformation, as well as the National Strategy for Semiconductor Industry Development.

Beyond industrial production, the factory is expected to play a significant role in human resource development. It will provide hands-on practice and experimentation opportunities for semiconductor students in Viet Nam, contributing to improved training quality and supporting the national goal of training 50,000 semiconductor personnel by 2030, including at least 35,000 workers in manufacturing, packaging, testing and other stages of the industry.

With this semiconductor plant, FPT takes another step toward closing the gaps in Viet Nam's semiconductor ecosystem, working closely with Viettel Group and other domestic partners to bring Vietnamese-made chip technology products into everyday life.

From assembly to higher-value segments

Viet Nam's involvement in the semiconductor industry began decades ago, primarily through foreign direct investment in assembly, packaging and testing. Major global players such as Intel, Amkor, Samsung and others established operations in the country, focusing mainly on lower-value segments of the semiconductor value chain.

Over time, Vietnamese engineers and local firms have gradually gained experience in chip design, a higher-value segment requiring advanced technical expertise and innovation capacity.

Recognizing the strategic and economic importance of semiconductors, the Vietnamese Government formalized a national semiconductor development strategy in 2024, targeting comprehensive industry development through 2030 and beyond.

To support this vision, Viet Nam has adopted enabling policies, including tax incentives, land allocation and investment incentives under the Digital Technology Industry Law and related legal frameworks. These measures aim to attract foreign investment while nurturing domestic semiconductor enterprises.

Toward domestic manufacturing capability

A pivotal moment in Viet Nam's semiconductor journey arrived in early 2026, when Viettel Group, a state-owned telecommunications and technology conglomerate, officially broke ground on the country's first domestic semiconductor chip manufacturing plant at Hoa Lac High-Tech Park.

Together with FPT's advanced testing and packaging facility, this development signals a coordinated effort by leading Vietnamese technology groups to gradually build a more integrated and self-reliant semiconductor ecosystem.

Challenges ahead

Despite growing momentum, Viet Nam's semiconductor ambitions face serious challenges.

Technological complexity remains a major hurdle, as modern chip fabrication demands ultra-precise equipment and highly specialized expertise that are still limited in emerging markets. Talent shortages persist, given that semiconductor engineering is highly specialized and time-intensive to master, with the industry still relying heavily on imported expertise while developing a domestic talent pipeline.

In addition, capital intensity poses a significant challenge. Building and operating semiconductor fabrication plants requires investments of billions of dollars, making competition for global semiconductor capital difficult amid established hubs such as Taiwan, the South Korea and the U.S./.