Viet Nam’s banking brands post high growth: Brand Finance

VGP - Vietnamese banking brands posted an overall growth of 31.3 percent in brand value, amounting over US$2 billion compared to their 2022 positions.

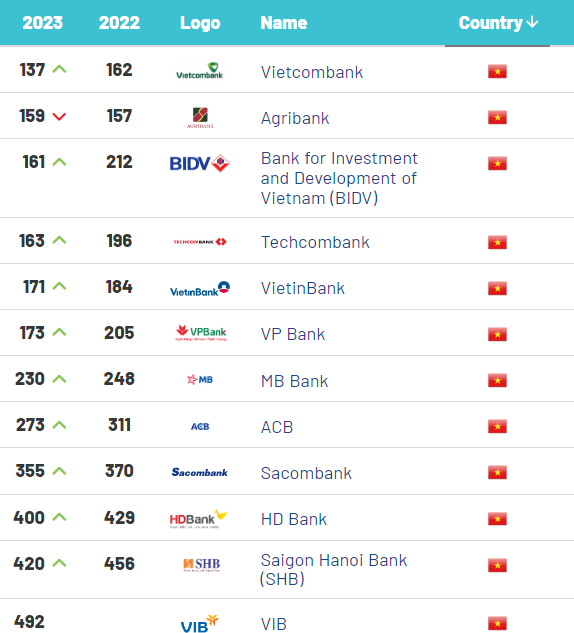

Twelve Viet Nam's banks in the Brand Finance's Banking 500 2023 report

The above figures are part of the Brand Finance's Banking 500 2023 report, which ranks the world's top 500 most valuable and strongest brands in the banking industry.

Almost all the 12 Vietnamese banking brands listed in the rankings improved their positions, with Vietcombank taking the lead among Viet Nam's banks, ranking 137th.

It was followed by Agribank at 159th and BIDV at 161st while VIB made its first ranking appearance in the list (492nd).

Brand Finance's research indicated that recovered revenue and revenue forecasts were important drivers of the impressive growth.

Overall, Vietnamese banking brands recorded improved business performances in 2022, underpinned by the nation's strong credit growth of nearly 13 percent, as well as remarkable economic recovery that is reflected by a GDP growth of 8 percent–its fastest pace in 25 years.

Managing director of the Asia Pacific of Brand Finance Alex Haigh commented that Vietnamese banking brands are rapidly adopting digital banking as a primary business and becoming leaders in this space regionally.

For instance, Techcombank (brand value up 46.7 percent to US$1.4 billion), the second-fastest growing Vietnamese banking brand in our study, is embracing digital banking, which has resulted in significant growth of its retail banking unit, he noted.

"Combined with Viet Nam's economic miracle, we note that Viet Nam's banks are well poised to be some of the best performing this year," noted Alex Haigh.

He expressed his belief that Viet Nam's banks are ready for consolidation in the next few years–given that the nation has many brands relative to its scale–to leverage efficiencies and bolster their strength.

If this proceeds, it is important that these brands play a central role in the process and that the resulting combined entities identify the individual brands that will deliver maximum value, he added.