Should telecom accounts give strong boost to cashless payment development?

VGP – We have invited three speakers to share their views on recent developments of non-cash payments and discuss way to boost non-cash transactions in Viet Nam.

Dang Hoang Hai, Head of the Ministry of Industry and Trade’s Department of E-commerce and Digital Economy;

Pham Trung Kien, Director General of Viettel Digital,

Phung Anh Tuan, Vice President and General Secretary of the Viet Nam Association of Financial Investors

|

Up to 99% of population use cash for payments of less than VND100,000 and nearly 85% use ATMs for cash withdrawal, reported the Institute.

Dang Hoang Hai, Head of the Ministry of Industry and Trade’s Department of E-commerce and Digital Economy. Photo: VGP

Recent developments of non-cash payments

Dang Hoang Hai: Data shows that there have been fast-changing trends, including non-cash payment in our society. Accroding to the State Bank of Viet Nam, non-cash transactions grew by 30% in terms value of non-cash payments increased by 18% in the first six months this year.

The above figures are encouraging but growth varies in different domains, especially in e-commerce.

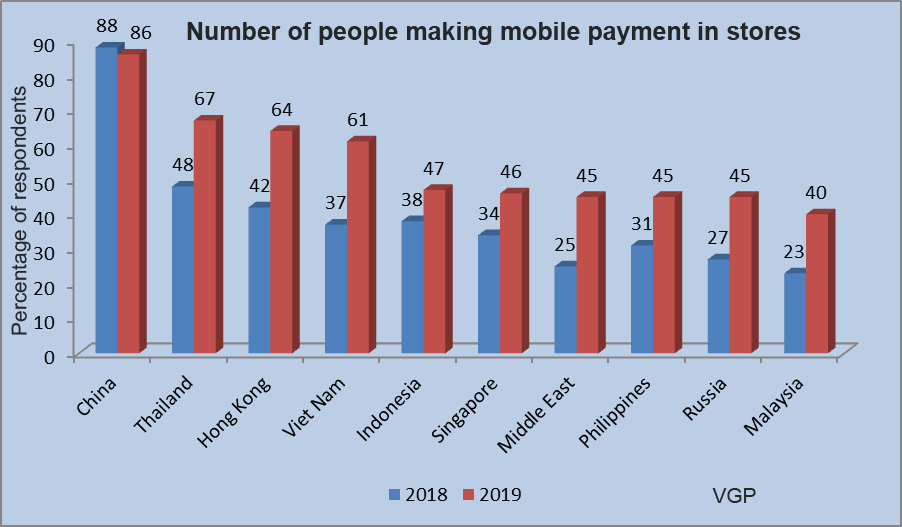

Pham Trung Kien: In 2019, Viet Nam tops the world in growth of mobile payment users though it had a very low starting point.

With dozens of fintech companies are in operation, the potential for e-commerce development in Viet Nam remains vast. Most of the cashless transacitons are simple, like money transfer and payment for electricity and water bills.

Phung Anh Tuan: A recent report shows that there are 154 companies operating in fintech in Viet Nam and most of them provide online payment services. Such number remains modest.

Pham Trung Kien, Director General of Viettel Digital. Photo: VGP

Policy development

Dang Hoang Hai: Under the directions of the Government, many reports have been developed recently to evaluate risks of using telecommunication accounts for payment.

We are preparing for adoption of legal corridor for payment via telecommunication accounts.

Phung Anh Tuan: There is a big policy gap between Viet Nam and other regional countries like Indonesia, Malaysia, the Philippines and Singapore.

However, big population in tandem with Government’s push for development of cashless payment is among Viet Nam’s advantages.

The Government has approved a project on non-cash payment and the Prime Minister signed Decision No. 999/QD-TTg approving a project to accelerate sharing economy model.

The above orientations need to be translated into concrete policies.

Pham Trung Kien: I hope that the Prime Minister will approve the proposal to use telecommunication accounts for small-value payment transactions as it will give a strong boost to cashless payment in Viet Nam.

Phung Anh Tuan, Vice President and General Secretary of the Viet Nam Association of Financial Investors (VAFI). Photo: VGP

Ways to increase cashless payment in e-commerce activities

Dang Hoang Hai: We need to create chances for citizens to experience directly to help them see through the benefits of cashless payment.

Pham Trung Kien: I think using telecommunication accounts for small-value transactions like paying for cups of tea or coffee, parking tickets and others. No one has use bank accounts for such transactions and only 30% of Vietnamese adults have bank accounts.

How to change consumers’ habits

Phung Anh Tuan: We can see that many new forms of banks have come into existence around the world thanks to technological advancements. This is a global trend that we must seek ways to catch up with.

Dang Hoang Hai: I believe that consumers should try non-cash payment services./.

By Quang Minh