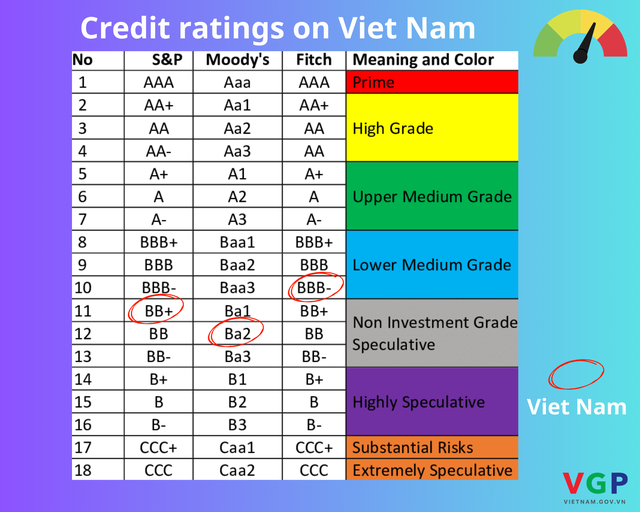

Fitch Ratings lifts Viet Nam’s credit rating to BBB-

VGP - Fitch Ratings has upgraded Viet Nam’s credit rating on senior secured long-term debt instruments from BB+ to BBB-, placing these instruments in investment-grade territory. The rating is now one notch above Viet Nam’s current BB+ rating for unsecured foreign-currency long-term debt.

Viet Nam's current BB+ rating for unsecured foreign-currency long-term debt.

The upgrade follows Fitch's assessment under its new Sovereign Rating Criteria, introduced in September 2025. According to Fitch, the decision reflects expectations of higher recovery prospects for sovereign-issued secured bonds, supported by additional recoverable value from guarantees or collateral.

In Viet Nam's case, the upgrade applies to the 30-year Brady Bonds issued in 1998, whose principal is partially or fully backed by zero-coupon U.S. Treasury bonds.

Fitch emphasized that the move does not affect Viet Nam's overall sovereign credit rating, which remains at BB+ with a stable outlook, most recently affirmed in June 2025.

Nevertheless, the upgrade is viewed as an important endorsement of the strength and credibility of Viet Nam's debt instruments in international financial markets.

The Ministry of Finance said it is establishing a regular and proactive dialogue mechanism with major international credit rating agencies, including Fitch, Moody's and S&P. Beyond data provision, these exchanges enable Viet Nam to directly highlight its institutional strengths, macroeconomic stability and growth potential.

According to the ministry, the BBB- upgrade resulted from close coordination and timely communication with Fitch, particularly regarding the structure and collateral features of Viet Nam's Brady bond liabilities.

Earlier, on August 11, 2025, S&P Global Ratings affirmed its 'BB+' long-term and 'B' short-term sovereign credit ratings on Viet Nam. The outlook on the long-term rating is stable./.

Similarly, in June 2025, Moody's Ratings affirmed Viet Nam's government issuer and senior unsecured ratings at Ba2 and maintained a stable outlook. The rating affirmation highlighted Viet Nam's high growth potential, improving macroeconomic stability, and attractiveness as a foreign investment destination. These factors provide resilience against potential negative credit implications from high U.S. tariffs on Vietnamese exports. Moody's noted that Viet Nam's credit profile benefits from strong fiscal metrics, including low debt and high debt affordability./.