More policies come into force today, benefiting people

VGP – Since January 1, 2010, more new regulations regarding people’s life will come into effect.

Since

January 1, 2010, people are issued with new health insurance cards

1. Higher health insurance

contribution

|

Since January 1, 2010, when

patients with health insurance enjoy medical services at their registered clinics,

the health Insurance Fund will pay: |

The Government’s Decree 62/2009/NĐ-CP

instructing the enforcement of the Health Insurance Law stipulates that, since January

1, 2010, the contribution to health insurance will be 4.5% of salary, wage,

retirement pension, or invalidity allowance, and 3% of students’ living wages.

The State budget will

offer subsidiaries equivalent to at least 50% of the contributions of poor

students and 30% from those who are not poor.

Also in 2010, the Việt

Nam Social Insurance will issue new health insurance cards.

All cards issued before January

1, 2010 and still valid in 2010 can be used until the holders leave hospital.

Under the Government’s

Decrees 97/2009/NĐ-CP and 98/2009/NĐ-CP, laborers’ living wages will be

categorized into four different groups of regions having different living

standards.

Accordingly, the

by-region living wages paid for unskilled laborers working in normal conditions

in domestic enterprises will be VND 980,000; 880,000; 810,000; and 730,000 per

month and in FDI enterprises: VND 1,340,000; 1,190,000; 1,040,000; and 1,000,000.

The new monthly wages are

VND 80,000-180,000 higher than the current one.

3. Interest rate

subsidies for medium and long-term loans

The Government decided to

provide interest rate subsidies of 2% per year in 2010 for medium and long-term

Vietnamese currency loans taken from commercial banks in order to serve agriculture-forestry;

fisheries; processing industry; science-technology; purchase and trading in

agro-forestry products, marine products and salt.

The decision aims to promote both growth recovery, economic restructuring, and macro-economic stability.

|

| Activities to purchase and trade in agro-products are provided with the interest rate subsidies of 2% per year in 2010 |

4. Stock income tax

imposed, import-export tariffs cut

|

|

|

To realize its WTO

commitment, Việt

The new tariff also combines 64 tax rates into 40 ones.

|

| Smoking at indoor public sites can be fined VND 50,000-100,000 |

Since January 1, 2010, the

PM’s Decision 1315/2009/QĐ-TTg imposes a strict ban on smoking in classrooms,

kindergartens, clinics, libraries, cinemas, theaters, culture houses, production

workshops and indoor working places, and means of public transport.

Punishments include warnings

and pecuniary penalty of VND 50,000-100,000.

6. Civil servants

pay compensation for their wrongdoings

The Law on State

compensation stipulates that individuals and organizations suffering material

and spiritual damages caused by civil servants in administrative and judicial activities

have right to ask for State compensation. For the first time, a Vietnamese law

clearly defines 11 illegal acts of civil servants, for which the State

compensation are required.

Civil servants who commit

intentional wrongdoings are forced to pay a part of the compensation.

7. Capital

punishment abrogated for some offences

The Law to revise and

supplement some articles of the Penal Code adds new regulations regarding

economic and environment crimes while abrogating capital punishment imposed on

eight offences, namely Rape; Fraudulently misappropriating citizens’ private

property; Smuggling; Forging currencies, concealing or circulating forged

currencies, counterfeit stamps, tickets or papers used in distribution; Organization

of illegal use of drug substances; Forcible takeover of aircraft or ships; Offering

bribe; and Destroying weapons or military equipment.

|

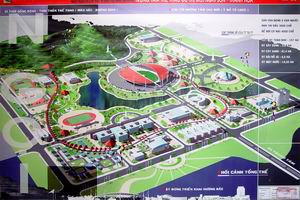

So far, there are 743

urban areas of all kinds, over 160 concentrated industrial parks, and 28 border-gate

economic zones throughout Việt

The Law on Urban Planning

stipulates that planners, when making urban planning schemes, must collect

opinions of all stakeholders and these schemes must be publicized within 30

days since their approval.

9. Unemployment insurance

paid for laborers

Officially applied since

January 1, 2010, unemployment insurance is compulsory to laborers and

enterprises. Through this kind of insurance, laborers can receive allowance in

case of unemployment and will have chances for vocational training, job

consultancy and health insurance.

Accordingly,

laborers shall contribute 1% of their monthly salary, employers 1% of their

wage fund and the State budget 1%.

Unemployment

pension for laborers is 60% of their average monthly wage paid during six

months before they become unemployed. They can enjoy the pension for a period

of time equivalent to their contributions to unemployment insurance.

By Hồng Hạnh