Ernst & Young upbeats about VN’s economic prospects

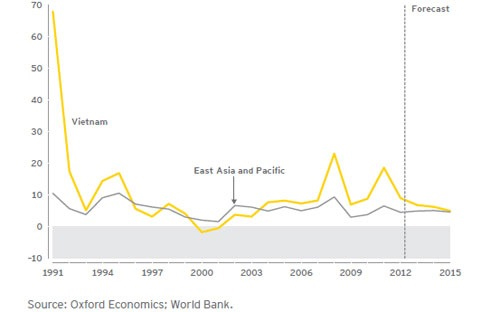

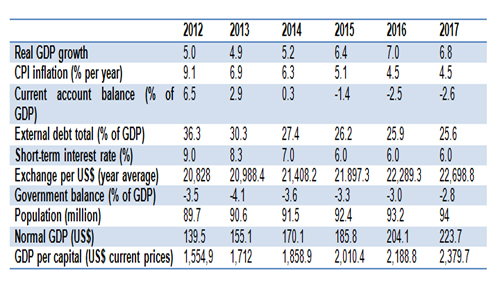

VGP – Real GDP growth rates for Viet Nam were projected at 5.2% in 2014 and over 6% in 2015-17, according to Ernst & Young (EY).

November 29, 2013 7:31 PM GMT+7

|

The report said that subdued export markets and persistent high real interest rates have kept the country's 2013 GDP growth close to last year’s 5%.

But a sustained pickup in prospect from 2014, as the past year’s strong inward investment rise starts to boost exports to faster recovering markets. Despite an inflation rebound in the second half of the year, policy interest rate cuts are set to resume in 2014.

This should precipitate a deeper fall in private sector borrowing costs as the banks continue to return to health.

Although the trade deficit will widen again from 2013, a generally balanced current account and rising FDI should ensure that the Vietnamese dong will depreciate only in line with inflation. This will widen the scope for monetary easing and continued loan growth.

Better trade access, rising remittances and receding energy constraints will also support medium-term growth and contain inflation. But linkages between the foreign-invested sector and smaller private firms are weak, and state-owned firms are set to maintain preferential credit access.

This could prolong inefficiency and overexpansion. Rising exports and FDI, and the fast-expanding domestic market will underpin growth in excess of 6% in 2015 and 7% in 2016-16.

|

By Kim Anh