Commercial banks – facts and figures

VGP – The State Bank of Viet Nam has recently announced the updated figures on the Vietnamese banking system.

|

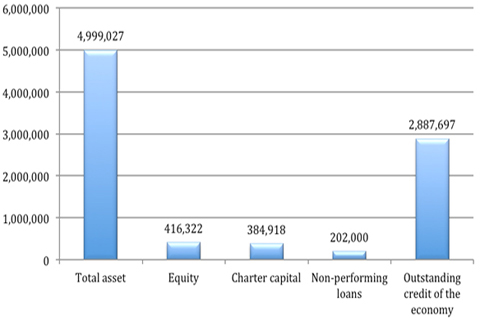

| Some financial norms of credit organizations as calculated by July 31, 2012 (Unit: billion VND). Outstanding credit was updated as of June 30, 2012. Non-performing loans by late Q1, 2012 –Source: The State Bank of Viet Nam |

|

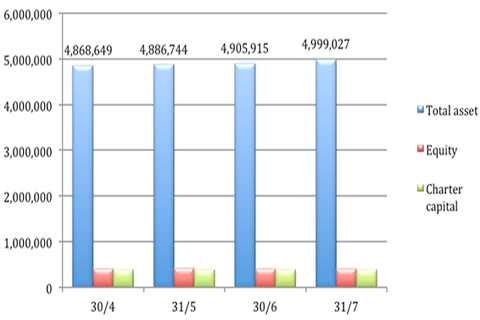

| Total asset, equity and charter capital of credit organizations in 2012 – Source: State Bank of Viet Nam |

|

|

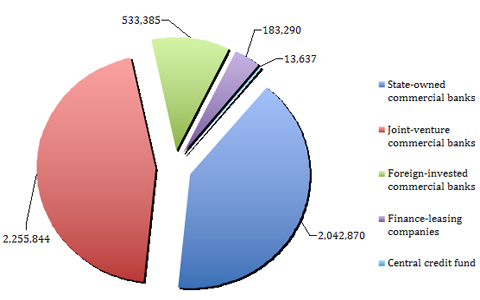

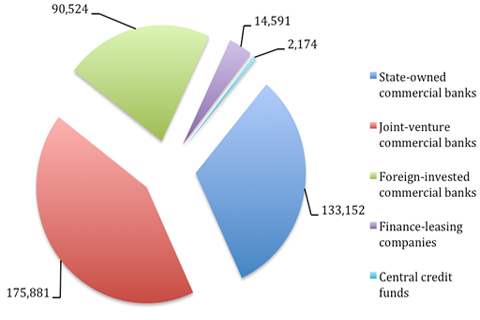

Total assets of credit organizations as calculated by July 31, 2012 (Unit: billion VND) – Source: The State Bank of Viet Nam |

|

|

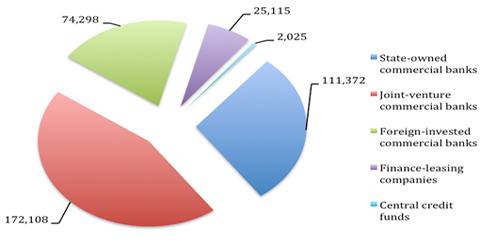

Charter capital of credit organizations as calculated by July 31, 2012 (Unit: billion VND) – Source: The State Bank of Viet Nam |

|

| Equity of credit organizations (excluding the Viet Nam Bank for Social Policies) as calculated by July 31, 2012 (Unit: billion VND) – Source: The State Bank of Viet Nam |

|

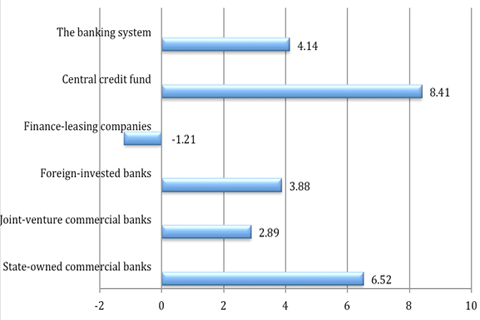

| ROE in Q2 (Unit: %) – Source: The State Bank of Viet Nam |

|

|

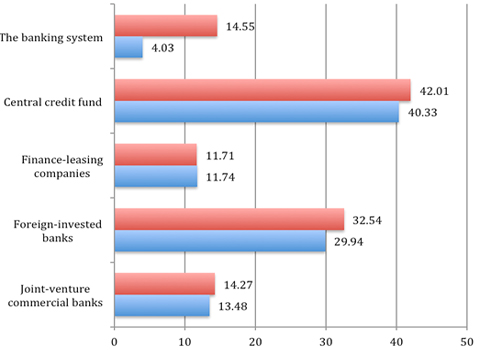

The rates of minimum capital safety in credit organizations until July 31, 2012 (excluding the Bank for Social Policies) – Source: The State Bank of Viet Nam |

|

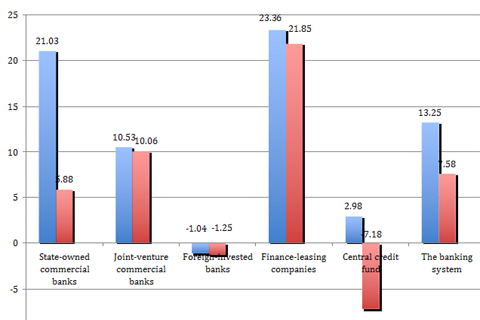

| The percentage of short-term capital for medium and long-term loans in credit organizations until July 31, 2012 (excluding the Bank for Social Policies) – Source: The State Bank of Viet Nam |

By Thanh Thuy