VN ranked 3rd in top non-BRIC emerging markets

VGP - Vietnam has been ranked as the seventh top emerging market, after the BRICs -- the economic grouping acronym that refers to Brazil, Russia, India and China -- for the 2012 – 2017 period, according to a report released last week by Finnish advisory group Global Intelligence Alliance (GIA).

|

|

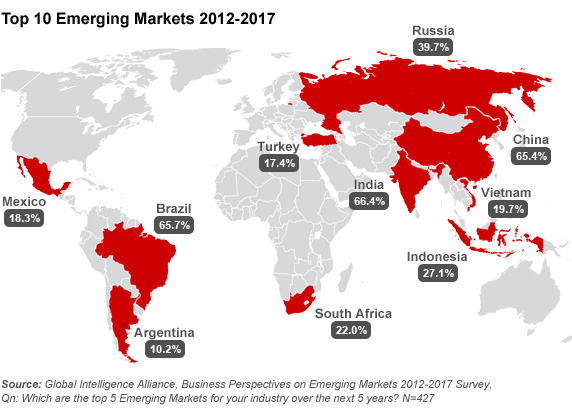

A figure shows the Top 10 Emerging Markets (2012-2017) by % all companies - Photo: Global Intelligence Alliance, Business Perspectives on Emerging Markets 2012-2017 Survey |

The Business Perspectives for Emerging Markets 2012-2017 shows that Brazil, India, China, and Russia still dominate the emerging markets and occupy the first four places, while Vietnam stands at 3rd place out of the top ten markets after the BRICs.

In the leading positions Brazil, with a 2012-2017 economic growth projection [by the IMF] of 3.7%, and Russia, 3.9%, are attracting global investment for reasons other than their growth rates, such as their potentially huge domestic markets, natural resources and dominance within their regions, the report notes.

It also states that most of the non-BRIC Emerging Markets that international companies plan to target in 2012-2017 are in Asia or Latin America, and Indonesia is the next upcoming Emerging Market, with over a quarter of companies naming it fifth after the BRICs.

It is followed by South Africa, Vietnam, Mexico, Turkey, and Argentina.

While U.S. and European companies are most interested in Indonesia and South Africa, GIA notes in the report that their second choice is between Turkey and Mexico, while Latin American companies focus more on their own home region, and Asian companies, thus, favor Vietnam.

“Of the secondary and up-and-coming emerging markets, Vietnam is favored amongst consumer and retail, logistics, as well as energy and resources industry players,” GIA states.

The report also says that international companies’ reasons for investing in emerging markets can be complex, but are usually mainly centered around the potential for building long term revenues and global market share more rapidly than is possible in established markets.

“It has become less about lower production costs, though this is still a driver for some. Almost all of the companies (91%) surveyed by GIA say they could have done something better in their emerging market strategy,” it says.

“The main regrets are not adapting more to local conditions, not entering sooner and not acquiring better market intelligence.”

GIA conducted the report based on an online survey run between April and May amongst business managers at 431 large and mid-sized companies and organizations worldwide.

Industries covered include: manufacturing and industrial; telecommunication, technology and media; professional and business services; financial services; consumer and retail; pharmaceuticals and healthcare; energy, resources and environment; automotive; chemicals; logistics and transportation./.