Fitch Ratings Upgrades VN’s Outlook Following Successful COVID-19 Containment

VGP – Fitch Ratings has recently revised Viet Nam’s Outlook to Positive, from Stable, at ‘BB’ thanks to strong export growth and a successful campaign to contain the spread of COVID-19.

The leading provider of credit ratings reported that Viet Nam’s public finance metrics have improved markedly relative to peers since the start of the pandemic.

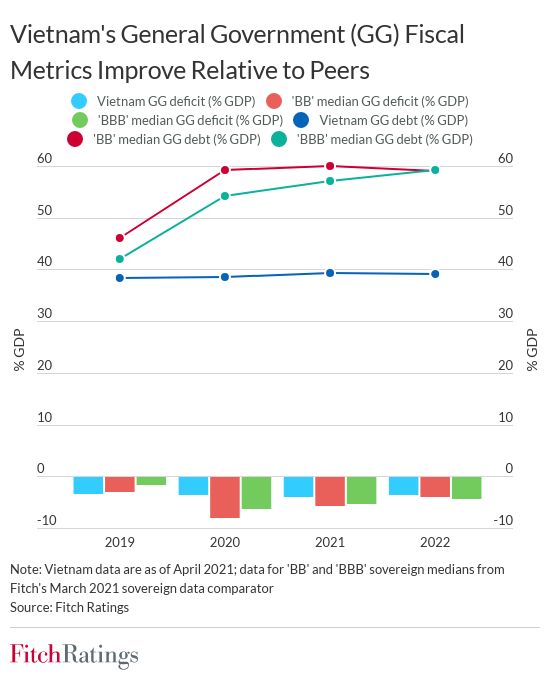

In December 2019, prior to its April 2020 decision to revise the rating Outlook to Stable from Positive amid uncertainties associated with the pandemic, Fitch Ratings had expected that Viet Nam’s general government (GG) debt/GDP would stand at 40.3% of GDP in 2021, against a median of 41.7% for ‘BB’ sovereigns and 43.8% for ‘BBB’ sovereigns.

Fitch Ratings projected that Viet Nam’s GG debt/GDP to average around 39% in 2021-2022, but the equivalent peer median forecasts have risen to around 60% and 58% for ‘BB’ and ‘BBB’ sovereigns, respectively.

Vietnam was one of only a few countries globally to post positive economic growth in 2020, of 2.9%. Growth was buoyed by external demand, with goods exports rising by 6.9%.

Fitch Ratings expects growth to remain strong, at around 7% annually, in 2021-2022, buoyed by continued export expansion and higher investment.

Earlier, Oxford Economics, the UK's forecasting and quantitative analyzing company gave positive assessments on Viet Nam thanks to the country’s rising role in the global manufacturing supply chains.

Viet Nam’s goods exports picked up 6.9% in 2020, a moderation from 8.5% growth rate in 2019, but still a solid achievement given world trade fell 7.8%.

The country was projected to take full advantage of the work-from-home-related global boom in demand for computers, other electronics, and furniture.

Viet Nam’s export manufacturing sector will be buoyed by a rebound in world trade this year. It forecast that as coronavirus-related restrictions are rolled back and vaccines become more widely available, world trade in real terms will surge nearly 10% this year.

Oxford Economics expected that the US$ 1.9 trillion relief stimulus package known as the American Rescue Plan will also likely bolster U.S. demand for Vietnamese exports.

|

By Kim Loan