Experts explain why Viet Nam should NOT be considered “currency manipulator”

VPG – The U.S. Department of Treasury’s decision to label Viet Nam as a “currency manipulator” is not satisfactory given the country’s real conditions.

|

|

Dr. Tran Hoang Ngan, Director of Ho Chi Minh City Institute for Development Studies |

>>> PM Phuc holds phone talks with U.S. President Trump

>>> VN has no intention for currency manipulation, experts say

>>> VN, U.S. develop healthy commercial relationship: AmCham

Dr. Tran Hoang Ngan, Director of Ho Chi Minh City Institute for Development Studies said Viet Nam is one of most open economies in the world and the country reported more annual trade deficit than trade surplus since it joined the World Trade Organization on 2007.

Viet Nam has expanded trade ties to than 230 countries and territories, signed over 90 free trade agreements and nearly 60 investment encouragement and protection, 54 agreements on double taxation avoidance and dozens of bilateral cultural cooperation agreements.

In 2020, global trade has been seriously affected by the Covid-19 pandemic. However, Viet Nam could gain trade surplus of around US$20 billion thanks to successful management of the pandemic and great endeavor of exporters.

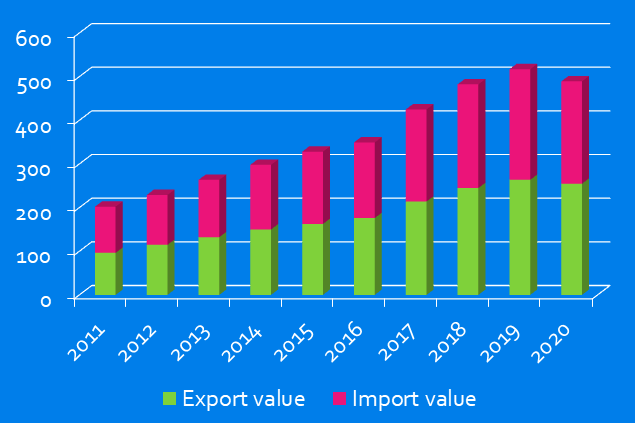

Ngan said Viet Nam’s export and import values rose significantly at the same time. If the country tries to devalue its Dong as argued by the U.S Department of Treasury, prices of imports will be higher, thus creating no advantages.

He expressed his belief that maintaining stability and consolidating investors’ confidence is more beneficial to Viet Nam than trying to devaluate the Dong.

|

|

Export-import value (billion usd) from 2011-2019 and first 11 months of 2020. Data source: General Statistics Office |

In the past, the Vietnamese economy had experienced instabilities due to high inflation and devaluation of the Dong. This is why the Vietnamese Government has consistently regarded macroeconomic stabilization as its top priority.

In his working session with the U.S. International Development Finance Cooperation (DFC), Prime Minister Nguyen Xuan Phuc reassured that the Government places top priority on macroeconomic stabilization and consolidation of the confidence of people and investors.

The Government chief said devaluation of the Dong could only lead to great losses to the whole economy.

In fact, the State Bank of Viet Nam (SBV) has strictly followed the Government’s guidelines to design monetary policies in favor of inflation control and macroeconomic stabilization.

If Viet Nam is not removed from the list of currency manipulators and the punitive tariffs are applied, made-in-Viet Nam goods will become more expensive.

Commenting on the Treasury’s move, AmCham Executive Director Adam Sitkoff said “currency manipulation has not been an issue for our membership, and any potential action in the final days of this administration to harm Viet Nam’s economy with punitive tariffs will damage the close partnership the two countries have developed over the years.”

Sitkoff added that tariffs or other retaliatory measures could have broad commercial implications for American companies doing business in Viet Nam.

Regarding Viet Nam’s US$100 billion foreign reserve, Ngan said the figure is quite modest in comparision with the yearly import value of US$260 billion.

The foreign reserve is only enough to cover three months long imports compared to five months in Singapore, eight months in the Philipines and the Republic of Korea, nine months in Thailand, and 14 months in China.

In recent years, the annual average inflation rate was around 4% compared to less than 2% in the U.S, therefore it is understandable that the Dong weakened by 1%-1.5%

As an open economy, Viet Nam needs sufficient foreign reserve to ensure safety against external shocks and the central bank’s purchase of foreign currency only aims to serve such need.

On current account, Viet Nam’s total trade surplus with the rest of the world stood at about US$5-10 billion a year, with exception of US$20 billion in 2020.

Viet Nam gained current account surplus mainly because of the inflows of remittance transferred by overseas Vietnamese, thus exchange rate has not been the factor that leads to the current account surplus exceeding the Treasury’s threshold of 2%.

Jason Furman, a nonresident senior fellow at the U.S. Peterson Institute for International Economics recently wrote that “Viet Nam did accumulate substantial reserves over the last year, but brought them to only 25% of GDP, which is less than the amounts that neighbors like Malaysia and Thailand have accumulated, and generally in line with other emerging economies.”

Viet Nam is projected to have a relatively small current account surplus of 1.2 % of GDP in 2020, down from the 3.4% surplus in 2019. The Treasury’s argument is based more on Viet Nam’s bilateral trade surplus, which has indeed increased with the U.S. But this surplus results more from a shift of export production to Viet Nam than from any policy change in Viet Nam.

Furman underlined that it is worth noting that Viet Nam’s currency changes so far this year have not been particularly notable, remaining virtually unchanged, compared with emerging G20 economies.

Of course, different countries had different equilibrium pressures on their exchange rates. But Viet Nam is one of the few countries that did not see a depreciating exchange rate relative to the U.S. dollar in 2020.

The monetary and exchange rate policies of Viet Nam - an economy 1 percent the size of the U.S., have only a minuscule impact on the US economy.

The US current account balance, trade balance, and real exchange rate are largely determined by domestic factors like US monetary policy, fiscal policy, and the saving and investment decisions of US households and firms./.

By Quang Minh

Follow us on Twitter @VNGovtPortal and Facebook page @VNGov