EuroCham Business Confidence Index hits seven-year high in Q4 2025

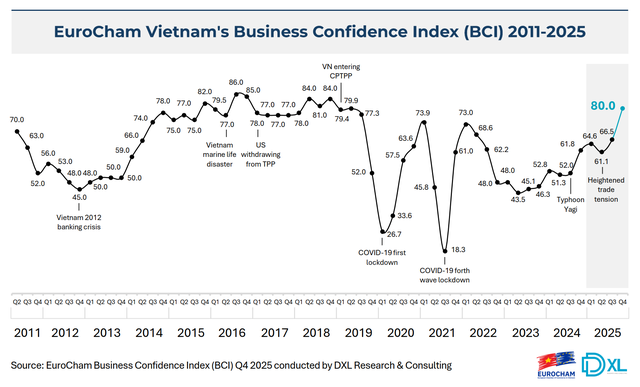

VGP - European business confidence in Viet Nam has reached its highest level in seven years, according to the Q4 2025 Business Confidence Index (BCI) released by the European Chamber of Commerce in Viet Nam (EuroCham).

The index surged 13.5 points quarter-on-quarter to 80.0, marking a decisive shift from nearly a decade of subdued or neutral sentiment shaped by the COVID-19 pandemic, global trade frictions and geopolitical uncertainty. The latest reading not only signals a strong rebound, but also surpasses both pre-tariff and pre-pandemic levels.

Conducted by DXL Research and Consulting, the Q4 2025 BCI captures sentiment across sectors and company sizes, offering a snapshot of how European firms assess current business conditions, future prospects and investment priorities in Viet Nam.

Confidence grounded in performance

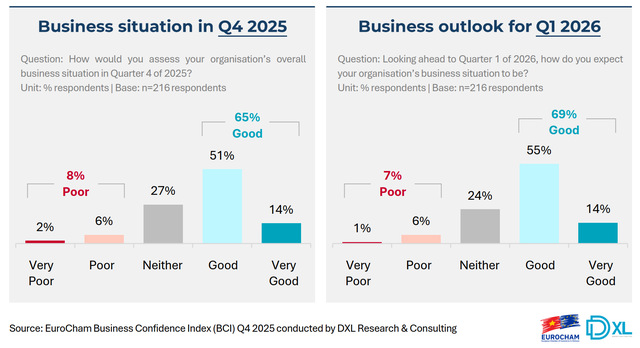

The sharp rise reflects broad-based improvements in both realised business conditions and forward-looking expectations. In Q4 2025, 65 percent of respondents rated their current business situation as positive, while 69 percent expressed confidence in their outlook for Q1 2026.

Actual performance also exceeded expectations. While only 56 percent of businesses surveyed in Q3 had anticipated positive conditions in Q4, the realised figure reached 65 percent, pointing to stronger-than-expected results.

This upswing closely mirrors Viet Nam's macroeconomic performance. GDP growth in the fourth quarter of 2025 reached 8.46 percent — the fastest quarterly expansion since Q4 2007 — and exceeded forecasts by major international institutions.

"Our latest BCI confirms what many of us have felt intuitively," EuroCham Chairman Bruno Jaspaert said. "After years of hovering around the mid-line, reaching 80 tells us that confidence is now grounded in delivery — in factories running, orders returning and investments being executed. Viet Nam is quickly transforming itself into a powerful growth engine, on track to rank among the top three economies in ASEAN."

Strong medium-term outlook

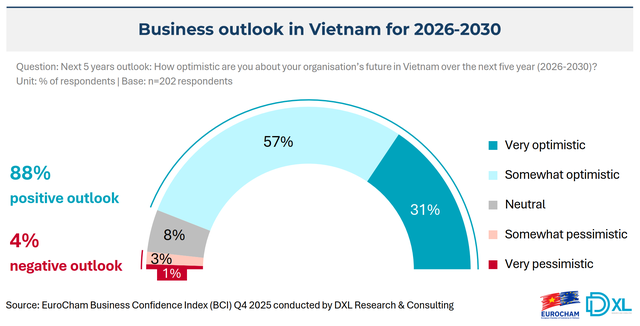

Beyond short-term gains, European businesses remain highly optimistic about Viet Nam's medium-term prospects. An overwhelming 88 percent of respondents expressed optimism about their organisation's outlook in Viet Nam for the 2026–2030 period, including 31% who described themselves as "very optimistic".

"Eighty-eight may sound like a lucky number, but it is much more than that," Jaspaert noted. "For our members, it reflects a rational assessment. Over the next five to seven years, provided it plays its cards right, Viet Nam is destined to become the place to be, entering a golden era of growth and transformation."

Business performance trends reinforce this sentiment. Sixty per cent of companies reported improved results in 2025 compared to 2024, while 82 percent expect further improvement in 2026. In addition, 87 percent of respondents said they are likely to recommend Viet Nam as an investment destination to other foreign businesses, with confidence strongest among larger employers with established operations in the country.

Global headwinds persist

Despite rising confidence, global trade tensions continue to weigh on operations. In 2025, 42 percent of respondents reported a net negative impact from global trade tensions, compared with 24 percent who experienced a positive impact, while 34 percent saw little or no effect. Smaller firms were more likely to report negative impacts, reflecting their greater exposure to volatility and more limited buffers.

"Despite global challenges, European businesses remain highly confident about Viet Nam," said Xavier Depouilly, General Manager of DXL Research and Consulting. "However, we see a divergence in resilience. Large multinationals are able to capitalise on their scale and invest for the long term, while SMEs are more exposed to external shocks and must prioritise short-term survival."

U.S. tariff policies and trade disputes were cited most frequently, mentioned by 46 percent of respondents. These pressures are felt mainly through demand shifts and revenue uncertainty (43 percent), followed by higher operating costs (16 percent).

In response, companies have focused on cost optimisation (41 percent), increased use of technology, automation and AI (35 percent), and, to a lesser extent, diversification outside Viet Nam (23 percent) or adjustments to investment and expansion plans. Notably, one-fifth of respondents.

reported making no operational changes, suggesting that for some firms, the impact remains manageable.

Resilience under pressure

Importantly, 56 percent of businesses said global trade tensions have actually increased their optimism about Viet Nam as a place to operate or invest.

"This is growth despite global turbulence," Jaspaert said. "After the so-called 'Liberation Day' tariffs announcement, many questioned whether Viet Nam would need to revise its 8 percent growth ambition. What we saw instead was resilience translating into results."

Viet Nam closed 2025 with GDP growth of 8.02 percent, a performance Jaspaert described as "very strong", particularly given the broader global economic environment.

The Q4 2025 BCI suggests that European businesses increasingly view Viet Nam not only as a resilient market amid global uncertainty, but as a long-term growth destination firmly back in strong expansion territory./.